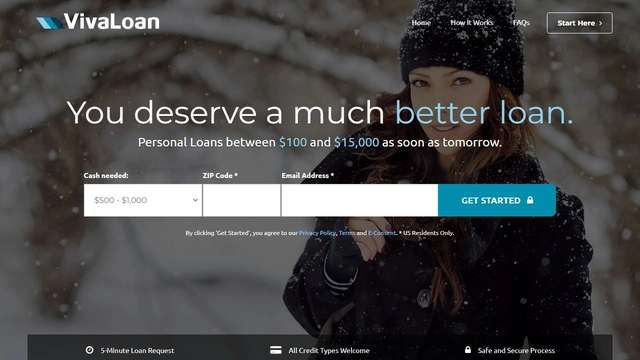

Vivaloan Affiliate Program

Key Features of Vivaloan Affiliate Program

How to Join Vivaloan Affiliate Program Step by Step

Before applying to join the program, take time to review all requirements and terms. This will help you understand if the program matches your promotional capabilities and audience interests in the Personal Loans space.

Follow these steps to become a Vivaloan affiliate:

- Choose your registration method from the available options

- Submit application and wait for approval (1-2 days)

- Get your tracking links and start promoting

The program is available through affiliate networks.

Target Audience for Vivaloan

Understanding the target audience is crucial for success in affiliate marketing. By creating content that resonates with these specific demographics, you'll increase conversions and maximize your commission earnings.

The target audience for Vivaloan encompasses individuals who seek accessible and straightforward financial solutions. These users value efficiency and clarity in the borrowing process, looking for a platform that simplifies the experience of obtaining personal loans. They often have varying financial backgrounds and credit histories, prioritizing options that cater to their unique financial situations while ensuring a safe and secure environment for transactions.

Primary Audiences

- First-time Borrowers: Individuals who are new to the loan process and seek a user-friendly platform to guide them through their first borrowing experience.

- Credit-Challenged Consumers: People with less-than-perfect credit histories looking for flexible loan options that accommodate their financial circumstances.

- Budget-Conscious Borrowers: Users who need to compare multiple loan proposals to find the best terms and rates that fit their budget.

Key Customer Characteristics

- Tech-Savvy Users: Individuals who are comfortable using digital platforms for financial transactions and prefer online solutions over traditional banking.

- Time-Conscious Borrowers: Customers who value quick and straightforward application processes, seeking to secure funds without unnecessary delays.

- Informed Decision-Makers: Users who appreciate transparency and clarity, wanting to understand their options thoroughly before making a financial commitment.