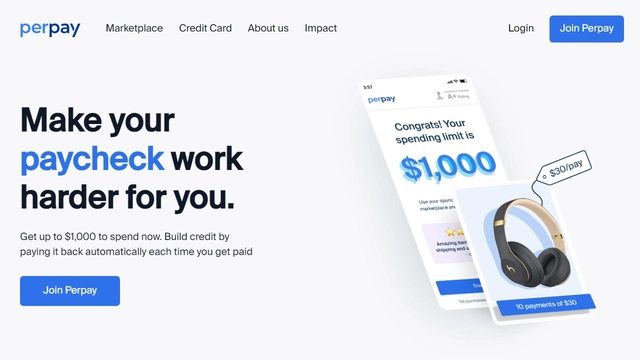

Perpay Affiliate Program

Key Features of Perpay Affiliate Program

How to Join Perpay Affiliate Program Step by Step

Before applying to join the program, take time to review all requirements and terms. This will help you understand if the program matches your promotional capabilities and audience interests in the Credit Cards space.

Follow these steps to become a Perpay affiliate:

- Choose your registration method from the available options

- Submit application and wait for approval (1-2 days)

- Get your tracking links and start promoting

The program is available through affiliate networks.

Target Audience for Perpay

Understanding the target audience is crucial for success in affiliate marketing. By creating content that resonates with these specific demographics, you'll increase conversions and maximize your commission earnings.

Perpay aims to cater to consumers seeking flexible financial solutions that promote responsible spending and enhance their creditworthiness. This audience values convenience, affordability, and transparency in their financial transactions. They are likely to appreciate services that help them manage their purchases better while avoiding the pitfalls of traditional credit systems. With a focus on fostering healthier financial habits, the target audience is inclined towards platforms that offer straightforward applications and personalized spending options.

Primary Audiences

- Budget-Conscious Shoppers: Individuals looking for ways to purchase items without incurring debt, who prefer manageable payment plans.

- Young Professionals: Early career individuals aiming to build their credit history while making essential purchases, such as electronics and home goods.

- Families on a Budget: Households seeking to acquire necessary items in a structured payment framework to better manage their finances.

Key Customer Characteristics

- Financially Conscious: Consumers who prioritize their financial health and seek options that allow for responsible spending.

- Credit Builders: Individuals focused on improving their credit scores through consistent and manageable payment practices.

- Tech-Savvy: Users comfortable with online platforms and digital transactions, looking for user-friendly financial solutions.